Why Are NFTs Valuable?

• 2 min read

You're Not Paying For Pixels

The right-click-save-as guys often remark that because they and everyone else can see images without paying, NFTs are not valuable. However, the opposite is true: those NFTs are valuable precisely because everyone can see the images.

The more people see an image, the more valuable the deed to the image becomes. Comparisons range from Birkin bags to autographed baseball cards to the Mona Lisa--the more people know of the Mona Lisa (via fascimiles, JPGs, etc), the more valuable the "ownership" of the Mona Lisa is.

Drilling in a little deeper, all the ERC721Metadata defines is a name, a symbol, and a URL, meaning the pixels are not even encoded on the blockchain as part of the token. You cannot query the blockchain for the pixels, but you can query the blockchain for ownership, and you are really buying ownership of socially recognized pixels.

Buying an NFT is a lot less like buying a coffee (where utility is consumption) and a lot more like buying a brand (where the utility is distribution). When buying an NFT, you're not paying for the pixels; you're paying for the eyeballs that have seen the pixels.

To first order, more eyeballs translates to more value in part because the price of the NFT is roughly the max of what each individual is willing to pay for it, and as more individuals know of the NFT, the max price point should monotonically increase in a ratcheting fashion. To second order, because more distribution of the underlying increases the max price points for certain participants, the price not only benefits from the new eyeballs, but increased value from previous eyeballs.

As an aside, statistically, this maximum-price formulation is why the NFT prices can be so crazy:

The sample maximum and minimum are the least robust statistics: they are maximally sensitive to outliers.

And in the presence of positive feedback loops--when crazy NFT prices beget news articles, which gets more distribution, which begets crazier NFT prices, etc--you get astronomical price increases for the most viral NFTs (because they're high priced, or because they're seemingly ridiculous, etc).

Other Value Sinks

So far, it seems ownership of an asset with its own distribution has been the main value sink for NFTs.

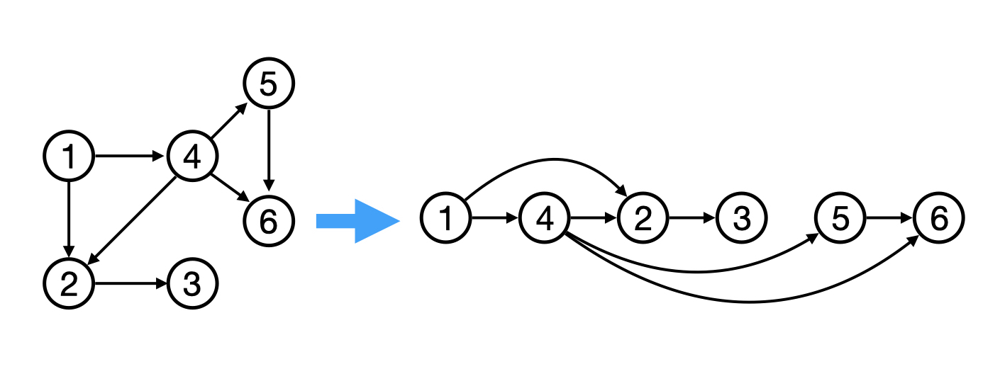

Similar to how a topological sort of a directed acyclic graph (DAG) splits out sources and sinks visually, where sources have no incoming edges and sinks have no outgoing edges, we can "topologically sort" the value graph of NFTs.

The more value sinks connected to a value source (NFTs), the more valuable that source is.

Here are a few more value sinks:

- Social Status (profile pictures, NFT museums via Rainbow)

- Lending (NFTFi)

- Trading (SudoSwap)

- Online Community (authenticated Discords)

- Physical Experiences (Bored Ape Yacht Club Yacht Party, The Place?)